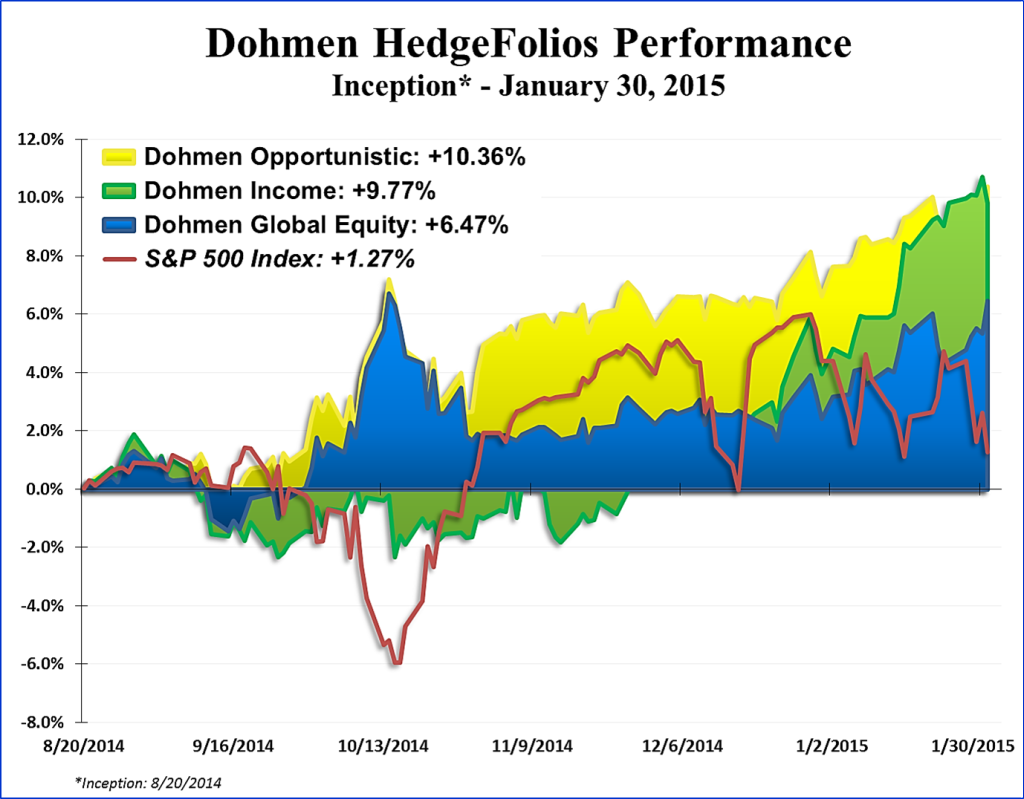

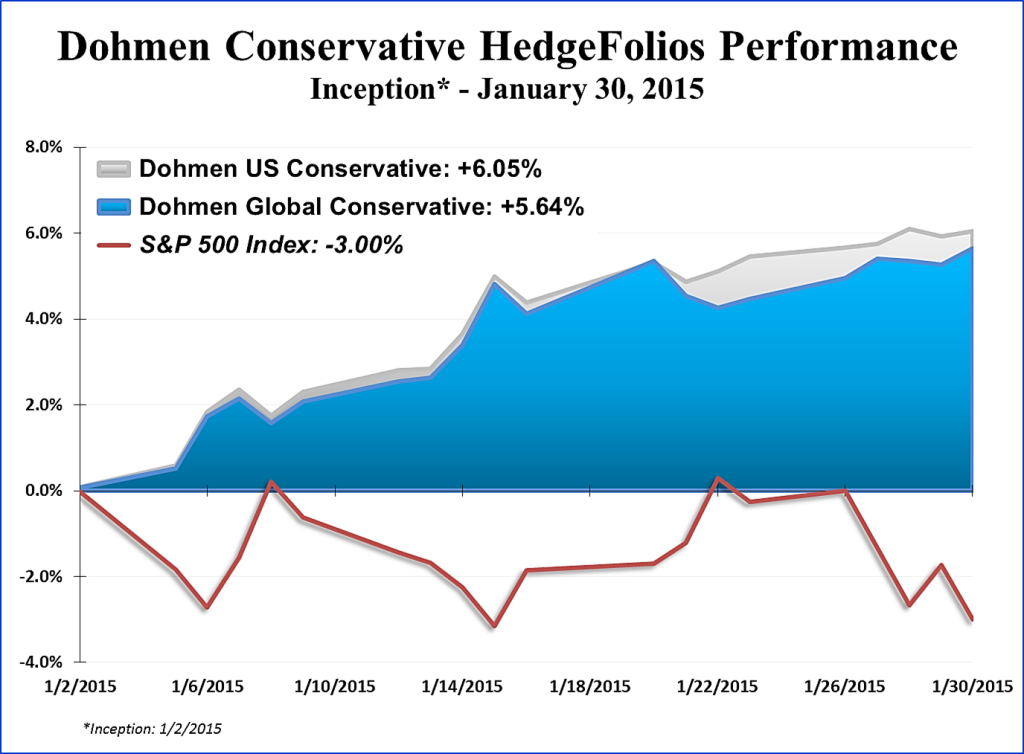

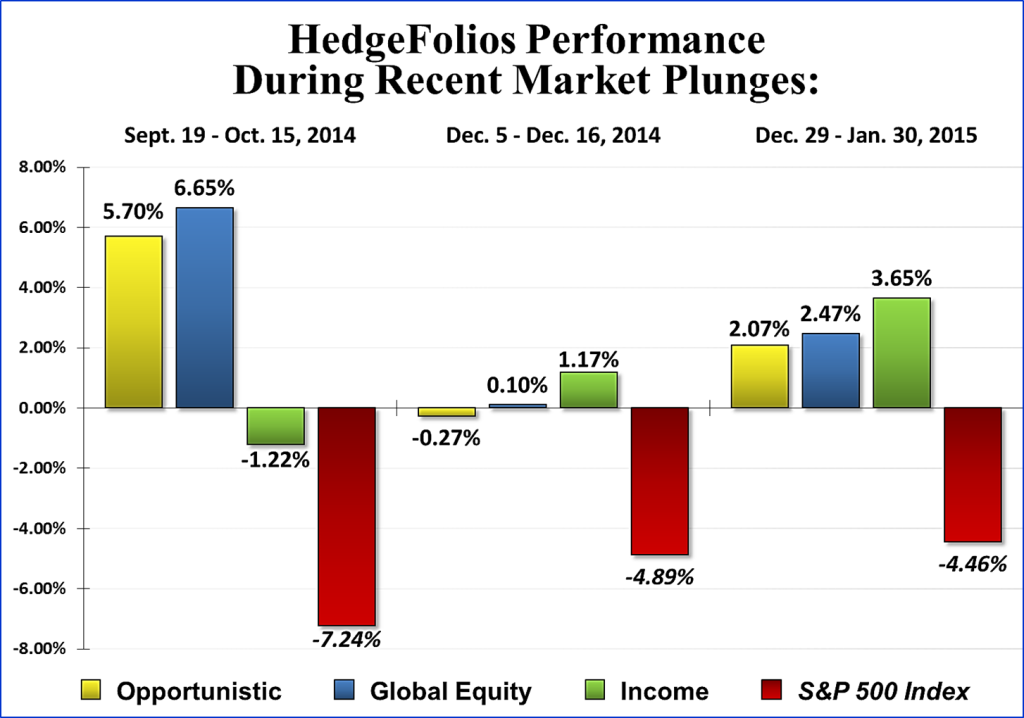

RECENT MODEL PERFORMANCE

Over the past few months, the Dohmen HedgeFolios have been preserving our members’ wealth and helped them to profit from the recent major market declines. Take a look at the model performance below during the late-2014 plunges and into 2015:

Performance is based on our model Folios, and does not constitute a composite for purposes of GIPS reporting. Cash distributions (e.g. dividends, capital gains, returns of capital) earned in a model Folio are automatically reinvested into the securities that paid them. Models are not validated or audited and may not reflect all entitled cash distributions. Model Folio returns are calculated using the Mid-Weighted Dietz Method, a time-weighted return, which is most useful for comparing performance to a benchmark. Consequently, these returns are not a measure of the actual profit or loss, or actual cash return of your portfolio or account. If you follow our model Folios, your performance may deviate from the performance displayed here depending on when you are able to update your actual holdings in the trading window, which immediately follows the email update notification you’ll receive after we make changes to our models. At launch, each model Folio has a hypothetical market value, which then changes over time based on the changing value of the underlying holdings. Corporate actions such as dividends, splits, spin-offs, etc., are processed in the same fashion as for funded Folios, with hypothetical money and shares exchanged rather than real dollars or shares. Model corporate actions are not validated or audited, which may result in errors in the performance results presented. Cash distributions (i.e., dividends, capital gains, returns of capital) earned in a model Folio are automatically reinvested into the securities that paid them. When model Folios are rebalanced, buys and sells are calculated to return the model Folio to its target weights—these hypothetical transactions assume a full execution of the shares needed at the closing prices on the day of rebalance. When the buys and sells cannot be offset exactly the resulting cash difference is hypothetically invested into FDIC.CASH— the symbol for our cash product. In most cases, this cash investment is a negligible portion of the model and will be hypothetically invested in the model holdings (if possible) in the next rebalance. Always remember, past performance is no guarantee of future results.