About Us

Bert Dohmen, Global Market Authority

Bert Dohmen is a serious professional trader, investor, and analyst. You’ve probably seen him on national TV, on programs like CNBC, Neil Cavuto’s show on FoxNews, and CNN, or read his views in Barron’s, the Wall Street Journal, Investor’s Business Daily, Business Week, and other publications.

As founder of Dohmen Strategies , he has been giving his analysis and forecasts to traders and investors for over 45 years.

Bert Dohmen looks behind the scenes of the global investment markets. He analyzes cross-market relationships, global correlations, and especially credit market data, all of which give him superb clues as to what is likely to happen in various markets that are ignored by other analysts.

Bert Dohmen has been called “a leading Fed Watcher” by the Wall Street Journal. Federal Reserve Board actions, worldwide politics and economies, along with fundamental and technical analysis give him the important clues.

His degree was in chemistry, with minors in physics and math. This made him a natural at reading charts. After beginning to invest for the first time in graduate school, he became unsatisfied with the conventional analysis of earnings, dividends, and other fundamentals, because these were backward-looking data . He was searching for a way to detect where hedge funds and other "smart money" institutions were moving their money today.

He discovered an old book in the university library about something called “technical chart analysis.” It was a classic, written several decades earlier. He immediately recognized it as what he had been looking for: using volume and price data changes, he could see what was happening now, not what earnings did last year.

He understood immediately why the different chart patterns in the markets worked. There was a simple logic that he loved. Thus he can predict a change in the price trend before the news is made public.

Bert Dohmen’s analysis often goes totally contrary to accepted “Wall Street Wisdom.” He is the original Fed Watcher, having made astounding predictions of Federal Reserve policy. He considers Fed policy the most important fundamental factor. Bert says that it isn’t easy, however, as he has to anticipate not only what policy should be, but also the mistakes the Fed is likely to make.

Bert Dohmen is the publisher of the Wellington Letter, an award-winning investment newsletter with an impressive 45-year record. He is also the author of the #1 best-selling books “Prelude to Meltdown” and “Financial Apocalypse”.

Predicting the Crashes

The bursting of the technology and internet bubbles of 2000 caused the greatest stock market crash since 1929 at the time, erasing over $9 trillion of wealth. Yet our clients prospered, making big profits.

In fact, on March 10, 2000, the day of the top of the internet and tech bubble, we wrote: “When the Fed pursues this policy it ends in a CRASH.” Bullish sentiment was extremely high, which was a confirmation that a top in the market was likely.

The next bull market started in 2002. Our subscribers, who had been safe during the big bear market, now had lots of cash. We got on board and were able to get back into the market at much lower levels.

After a 5-year bull market, the warning flags were flying again according to our analysis, especially in the credit markets, which are much more important than the stock market.

During the 2002-2007 bull market, our clients once again had the opportunity to make a fortune with Bert Dohmen’s advice. Many consider Bert Dohmen “the Independent Market Authority.”

During 2007, Bert said:

You can prosper during the coming, devastating bear market.

It will make the bear market of 2000-2002 look like a walk in the park.

“Buy and Hold” is dead!

These were the words proclaimed by analysts as the global crisis of 2008 was developing.

During 2007, Bert Dohmen predicted that 2008 would see an immense global financial crisis, the worst since the 1930’s, brought on by all the shenanigans from Wall Street institutions and the large banks. In fact, he felt so strongly he did something he never wanted to do: write a book. It was titled: “Prelude to Meltdown.”

That bull market top in the Dow Jones Industrial Average was on October 11, 2007. How did Bert warn his clients at the time?

The October 15, 2007 issue of our Wellington Letter had the subtitle: “The Eye of the Hurricane.” It declared that the bull market's top had been made.

Wall Street didn’t declare the bear market until June 2008. Our clients were way ahead of the pack, having been forewarned and protected from devastating losses.

In his book, Bert predicted that the global financial system would go to a near-meltdown state in 2008. That forecast was widely disregarded and most investors didn’t believe it would happen.

It’s a fact that “denial” is the most destructive of our emotions. It’s human nature not to want to believe the possibility of something very unpleasant. But, in the end, Bert Dohmen was right once again.

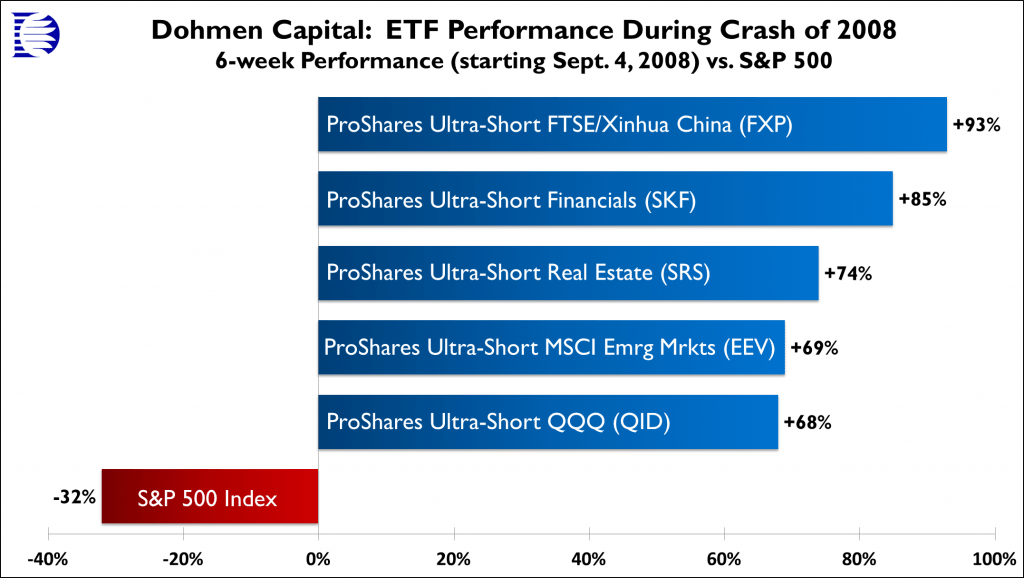

On September 4, 2008, the very day the credit crisis became serious, he recommended that our clients buy inverse ETFs, which are designed to rise in price as their respective sectors or indices plunge. These had extraordinary gains over the next five weeks, gaining an average of 72% during that time.

Our clients were smiling during the crisis, as they have been during every bear market over the past 45 years.

By early 2009, it was estimated that total global wealth destruction resulting from the crisis was near $64 trillion. At the time, that was almost five times the annual GDP of the U.S.

However, our clients prospered, taking full advantage of the bear market strategies our firm has developed over more than four decades. Bert Dohmen has always said that bear markets actually bring greater opportunities than bull markets, because stocks decline faster than they rise. Furthermore, the bearish side is not as crowded.

Investors must remember that the markets operate in cycles. On March 6, 2009, we gave a signal in our Dohmen Capital Research services to start closing out short positions, which had been very profitable up to that point. As we know now, that was the exact low of the devastating bear market. On March 9, after the weekend, we gave buy recommendations, writing that the up-move would last longer than even the bulls expected.

With Bert Dohmen and Dohmen Strategies’ analysis, you don’t have to be an investment pro: just follow our insights and forecasts to help enhance your own strategy.

It’s easy to make money during a bull market. As the saying goes, “a rising tide lifts all boats.” However, for over 45 years Bert Dohmen has shown his clients how to profit even during devastating bear markets. With our elite HedgeFolios active investing service, you too can learn how to enjoy bear markets and crashes.