How it works

How Easy Is It To Get Started With Hedgefolios?

How Does Hedgefolios Work?

HedgeFolios is the most convenient and efficient way for serious investors to follow our professional investment guidance. It offers complete transparency and liquidity with an incredibly easy-to-follow investing process.

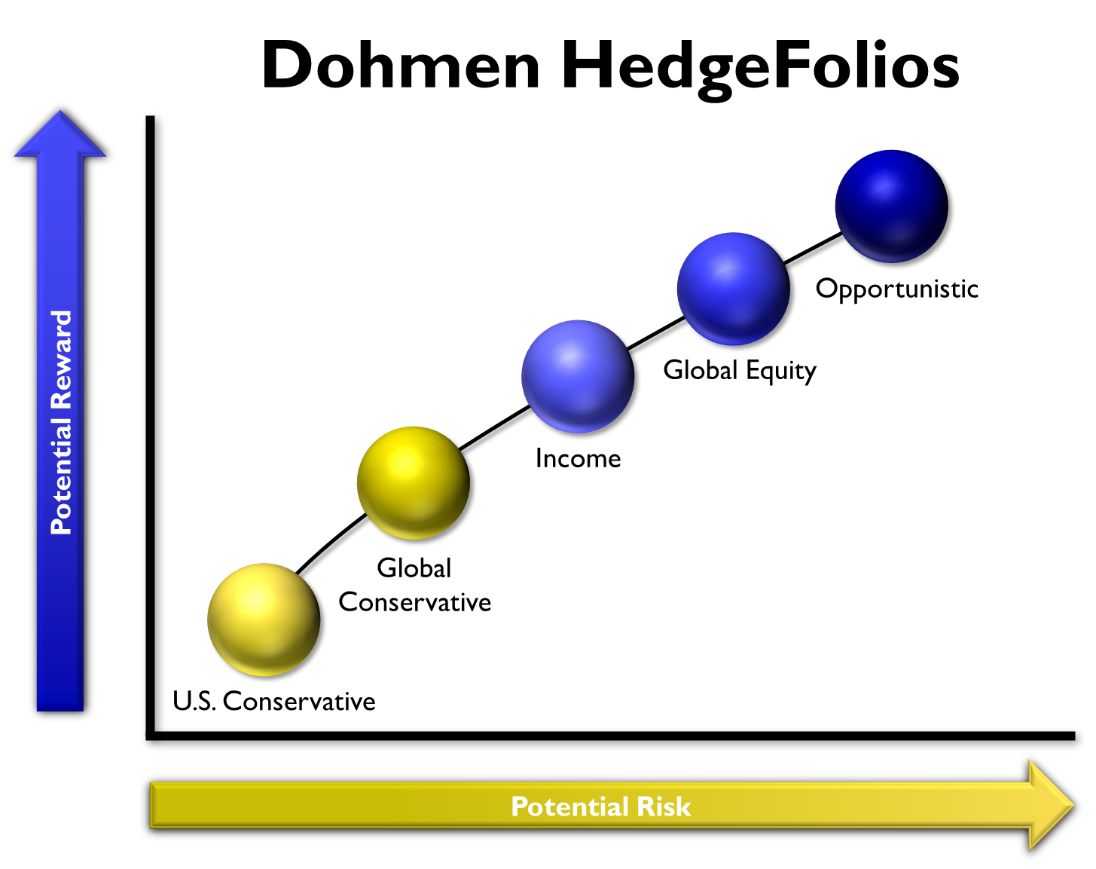

Dohmen HedgeFolios

- Our three flagship HedgeFolios are designed for investors seeking long-term income and capital growth, whether from equities or fixed-income securities

- Consist of ETFs and mutual funds that invest in high paying dividend securities, globally diversified securities, or small and large cap securities.

- Can utilize inverse ETFs and inverse mutual funds when appropriate as a hedge.

Global Equity: Utilizes ETFs and mutual funds that invest in any U.S. or international securities allowing global diversification in the potentially strongest sectors. When appropriate, it can utilize inverse ETFs and inverse mutual funds to hedge or profit from declines in specific sectors or indices.

Income:Utilizes ETFs and mutual funds that invest in securities paying income from dividends or interest. When appropriate, it can also utilize vehicles not oriented to income, such as inverse ETFs and inverse mutual funds to hedge or profit from declines in specific sectors or indices.

Dohmen Conservative HedgeFolios

- Designed for investors who prefer a more conservative investing strategy

- Consist of ETFs and mutual funds that invest in lower volatility equity and fixed income securities.

- Do not use inverse ETFs containing equities to hedge during stock market declines but instead seeks protection during adverse times by having higher cash positions and/or using high-grade fixed income ETFs and mutual funds.

U.S. Conservative: Utilizes ETFs and mutual funds that primarily invest in U.S. large-cap, mid-cap equity, and fixed income securities.

Simplicity, Transparency, And Professional Guidance

You have total control of the money in your portfolio, with the freedom to make changes to your positions if needed, while still getting timely updates whenever we make changes to any of our model HedgeFolios. You can even switch from one HedgeFolio to another if your investment goals change, providing you with flexibility in your investments.

You have a choice of several of our special HedgeFolios, each with a different goal and investment area. We watch all positions in the model HedgeFolios on an ongoing basis and implement changes in the model when our analysis calls for it. Our professional guidance can help grow your investment portfolio, as well as make it a much more simple and transparent process. IT’S THAT SIMPLE!

Don’t wait for the next bear market or crash. Act today! When Bert Dohmen speaks at a major conference, there are constantly some people who say to him, “I wish I had listened to your warnings in 2007-2008, in 2020, and in the 2022 Bear Market.” Don’t become someone who says to him in a few years, “I wish I had listened to you in 2023.”