Dear Investor,

Most analysts on Wall Street and financial media will look at fundamentals to conclude where this market could be heading. Being market contrarians, we offer a different take.

Most analysts on Wall Street and financial media will look at fundamentals to conclude where this market could be heading. Being market contrarians, we offer a different take.

As we have seen since the election, politics are playing an increasingly important role in the investment markets.

Therefore, we ask, will the new President be successful in getting his new programs and policies passed, or will he be blocked every step of the way?

The difference between the two may mean an even greater bull market or a major stock market collapse.

Remember the disasters of the recent past! The NASDAQ 100 index crashed 82% from the year 2000 to 2002, and plunged 54% from 2007 to 2009.

You may say that those two crashes were exceptions. One was the internet bubble implosion and the other was the housing bubble bursting. Every crash has a reason, and the reason is usually different than the last one.

However, it’s a fact that implosions of bubbles happen all the time, which spur the transition from bull markets into bear markets.

Could we be on the verge of such a “bubble burst” right now?

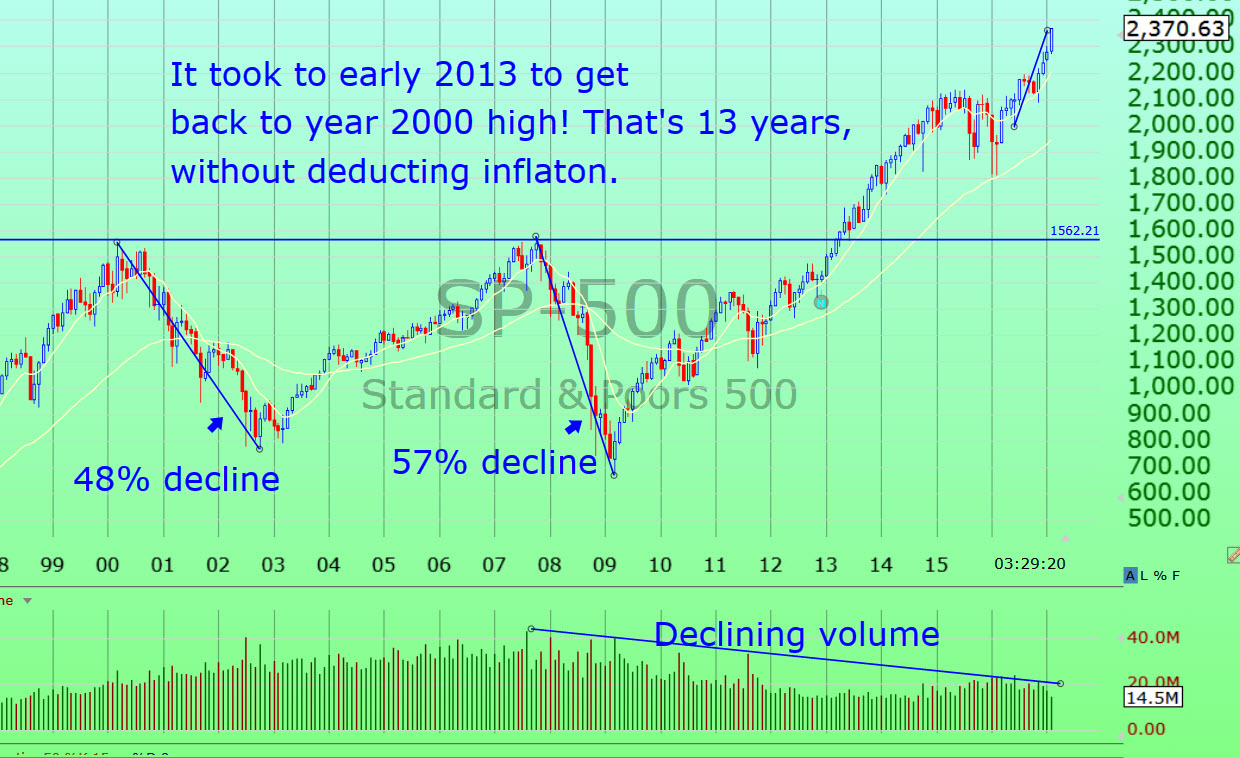

Take a look at the S&P 500 since 1998. You would have had nice profits at the top in early year 2000, which is when we gave a major sell signal. Thereafter, the index plunged 48%.

Would you agree that this would have been very painful for your investment portfolio had you stayed in the market?

But if you followed Wall Street’s “buy and hold for the long-term” advice, you may have stayed in and participated in the bull market into the year 2007 top. Nice profits, right?

But you would be back to where you were in 2000, not deducting for inflation.

Our sell signal in early 2000 would have kept you safe.

Then came the next bear market in 2007. We gave a major sell signal just a few days after the top in October 2007. Once again, most investors lost all their profits in the bear market, and more, as the S&P 500 declined 57%. Some sectors actually plunged as much as 80%.

|

Volume has declined during this entire bull market. That means that less money has been going into stocks as the indices rose to new record highs! |

Such crashes are incredibly painful to anyone’s portfolio. Perhaps you did what Wall Street always preaches…you stayed in “for the long-term.”

If you can withstand the torture of “water boarding” or walking on hot coals, you would have survived emotionally, although your wife, cat, and dog, may have left you.

But a least you were ready for the recovery that started on March 9, 2009, when we gave a “buy” signal. Once again, we caught a major market turn within a few days.

The rise since that time has been exceptional. Now, some indications are that the market is getting over-extended. Volume has declined during this entire bull market. That means that less money has been going into stocks as the indices rose to new record highs.

Our Rule: When The Price of Any Investment Rises on

Declining Volume, it Creates a “Demand Vacuum.”

Sooner or later that investment will collapse.

However, this is not a “timing signal.” For that we use other forms of advanced technical analysis.

We predict that at the ultimate top of this bull market, virtually everyone will be fully invested. And that will make the ensuing plunge potentially record breaking.

Are you willing to ride through another big bear market and perhaps the most damaging market plunge in history?

If you are a glutton for punishment, you might find that thrilling. For the average person who has worked hard for his capital, it will be more productive to get out anywhere near a top, and then have the cash to reinvest at the bottom when the masses will be more interested in selling.

Remember this: The big profits are made when you “buy,” not when you sell. The “buy” price is the determinant.

It is obvious that buying anywhere near the bottom and selling anywhere near the top can significantly increase your investment performance. And you don’t have to catch the exact day, or week, or even month of the top.

No one can predict the future with 100% accuracy, but having over 39 years of experience in the markets, as we do, can help in getting it right.

|

The big profits are made when you “buy,” not when you sell. The “buy” price is the determinant! |

This is not the time for the static portfolios of robo-investing or other schemes that give investors the false comfort of professional management, when in reality the portfolios may just be static allocations that remain more or less the same in bull and bear markets.

The defense of proponents of “buy and hold” investing is that over a 50-year period, the stock market rises.

What they don’t mention is that during 50 years, some of the major indices have lost up to 80% of their value. Most people will panic and sell near the bottom at huge losses.

How would you react to such a loss of your retirement nest egg? Yes, “buy and hold” is great in theory, but not with real money…your money.

The Next 2 Years Will Offer Tremendous Traps For

Those Who Follow The Crowd…

…yet provide great opportunities who feel comfortable taking contrarian positions, opposite to what is recommended by most on Wall Street who have big conflicts of interest.

For this reason we developed what we consider a revolutionary approach to professionally guided portfolios that serious investors can easily follow. It is NOT a managed account, as you remain in full control, but have our guidance at your fingertips.

Introducing our revolutionary HedgeFolios program, designed to participate in the bull markets and be protected during the big bear markets.

If you want to take the worry out of your investments, let our HedgeFolios be your guide, allowing you to replicate any of our 5 portfolios with just a click of the mouse. It couldn’t be easier!

There is nothing like it, anywhere, at any price.

The strategy for our HedgeFolios is proactive. We use advanced technical analysis to identify major turning points in the different sectors, whether industry sector, geographical, or type of investment vehicle.

And during times like these, we utilize investments which protect your assets, and may even rise as most stocks decline.

|

The revolutionary HedgeFolios program allows you to manage your own portfolio according to the model HedgeFolios established by global market authority, Bert Dohmen. |

You have “peace of mind” knowing we are watching the markets for you and monitoring the HedgeFolios. This delivers the “worry-free” investing you always wished for.

Now you can be in the “winning minority” by joining HedgeFolios and gain the many advantages HedgeFolios has to offer your investment strategy. We have a brand new “Gold Quarterly Membership” for those who wish to try the HedgeFolios program on a shorter-term basis.

For a limited time, you can save 15% with the new Gold Membership. For an even bigger savings, sign up for our “Platinum Annual Membership” and save 25%.

Let our professionally guided portfolios help you invest successfully in these tumultuous markets, so you can be protected from the plunges and profit from them.

Preserve your wealth with our guidance today!

Click the Button Below To….